Don’t Get Caught Without This In Your Wallet!

Cash. It never used to be controversial, but these days it appears that there are those on both sides of the coin (so to speak). For those of us of a certain age we can remember our mothers always telling us to keep a $20 bill in our shoe or bra, in case of emergencies. Now many of us struggle to find a coin to put in the meter.

Cash lovers, and those who never carry it. What’s the reasoning, either way? A Redditor was thinking the same thing, and asked the question, Do You Still Carry Cash? These are the answers they got.

Do you still carry cash? And for what?

Food and Those Pesky Tips

Many people eat out a lot and that has become a mine field of taxable opportunities; carrying cash comes in handy: “I do now, mostly to avoid being asked to tip 30% on a sandwich that I carried out”.

Of course, the snarky commenters had to weigh in: “I like it when people tip 30%. That way when I tip nothing I think to myself that when I’m averaged with the other guy before me it comes out to a nice 15%”.

Nothing Like Cold Hard Cash

“I always carry cash, and always have… usually $400 in assorted bills. For most things, I use my debit card like everyone else, but occasionally a situation can arise that will require cash…. credit card machines down, etc. It’s come in handy a number of times”.

Amount Of Transaction Counts

For small transactions, several commenters agreed that cash is the way: “I like to keep a small amount of cash. I don’t know why, but I hate swiping my card for transactions under $5”.

The True Cost Of Not Using Cash

How about this take? “Digital money is a failure in disguise. The amount of charges and automatic payments and subscriptions racked onto a checking account number can almost feel like the financial equivalent of being constantly siphoned. Couple years ago I switched to cash. Watched as my savings racked up and my spending plummeted, while my quality of life remained the same”.

This post on Facebook did a great job of explaining the true cost of cash:

“Please understand what NOT using cash is doing. Cash is important. Why should we pay cash everywhere we can with banknotes instead of a credit card?

I have a $50 banknote in my pocket.

Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping.

After an unlimited number of payments, it will still remain a $50, which has fulfilled its purpose to everyone who used it for payment and the bank has jumped dry from every cash payment transaction made…

But if I come to a restaurant and pay digitally – Card, and bank fees for my payment transaction charged to the seller are 3%, so around $1.50 and so will the fee $1.50 for each further payment transaction or owner re laundry or payments of the owner of the laundry shop, or payments of the barber etc…..

Therefore, after 30 transactions, the initial $50 will remain only $5 and the remaining $45 became the property of the bank thanks to all digital transactions and fees.

Small businesses need your help and this is one way to help ourselves too. Pull small draws of cash out at a time and use that instead of tap, credit, etc.

When this is put into perspective, imagine what each retailer is paying on a monthly basis in fees at 3% per transaction through their Point Of Sale machine.

If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month.

That would go a long way to helping that small business provide for its family!”

Drugs? Or Maybe Not

Some folks joked that of course they carry cash, for their drug buying, because as one commenter said, “Of course, I’m not gonna buy drugs with a credit card”, to which another just had one word to add: “Venmo”.

So that opened a discussion about Venmo and the fact that there is a “Venmo friends activity feed”. You can see what others are spending money for.

Apparently, some kids write in that they are buying “drugs” when they are paying their friends back, or just paying for food. The IRS must love that.

Cannabis

For those where cannabis is legal, there were comments such as, “The dispensary next door is cash only”. Other dispensaries take cards “but charges a fee, cash is still king”.

COVID Changed Things

“When COVID started, my employer stopped accepting anything except plastic, so we weren’t handling cash/checks. We fought like hell at the end to stay cashless; one for cleanliness, but two because requirements to handle, store, and transport cash in my org is so complicated, labor intensive, and time consuming. Thank goodness he supported us and we only take credit/debit cards”.

Risk Tolerance

A few posters took risk of ID theft into account. As one put it in reference to small purchases: “Risk tolerance I suppose. The risk of your card details being stolen isn’t worth those transactions”.

Emergencies

Sometimes cash is the way to go, like for emergencies. Here are two comments that make a whole lot of sense:

“Yep 40€ emergency money, you never know when the banks have an outage”.

and

“Yes. You never know when your card will be rejected for no reason. I carry an extra 100 hidden in my wallet for emergencies”.

Budgeting

Others pointed out that paying with cash helps you stay within your means. “Of course. It’s easier to stay on a budget if you pay cash” said one.

And this smart tip: “I used to tell myself that I was making a smart financial choice sticking to my rewards cards. After all, if taking cash out costs a percentage while swiping a card returns me a percentage, the choice is clear. What I didn’t take into account – or more likely refused to admit – was that it’s way easier to just keep swiping your card and avoid hitting refresh on mint than it is to avoid counting the cash left in the weekly budget. I’ve dropped my discretionary spending by about half since switching to cash”.

Discounts

Sometimes a deal can be had with cash: “One would be amazed at a discount with a lot of shops you can get if you let them know you are paying in cash”.

“I’ve gone back to cash for a lot of things. Especially local diners and small businesses who have to pay for their credit card transactions. My local diner will give a 3% discount if you pay by cash. Although I always give that back to the staff–better that they have it than the credit card companies”.

Cash & Nothing Else

Several people said cash was all they used:

- It’s all I use.

- Yes, I usually have a few hundred in cash in my wallet most of the time.

- Cash rules everything around me.

- Absolutely. Cash is still king in America.

- Yes cash is still king and can get you into or out of things a card never will.

- Always I usually still pay with cash.

- When I get below $100 in cash – I start looking for an ATM.

- Always. Cash can’t be declined.

- A gentleman always carries cash, primarily for those situations where only cash will solve a problem.

How Do You Carry Cash?

How all these cash carriers are toting their money became a topic of discussion. It all started to get lively when Pond_Minnow said: “No wallet. I only pay in cash. I stay with about $500 in my pocket usually”.

Folks had things to say: “Why don’t you carry a wallet? The money is gonna degrade rolling around with your pocket lint and boogers”, and “People like this make me hate my cashiering job. Nasty money all wrinkled and covered in sweat. I freakin’ gag. Then I gotta hand that nasty money out to customers too. Just know almost all your cash is covered in human juices and cocaine”. Okay then.

When In Switzerland…

Cash usage can vary depending on here you live.

“Yes. Here in Switzerland a lot of transactions are still done with cash. No transaction fee, and no one needs to know about it. 2-3 years ago the central bank updated the banknotes, you could go in there with 50k in cash to swap for the new ones and not even give your first name”.

And Over In The UK…

“During my 2 week trip to visit my daughter in London last year, I never used cash once. The grocery store near her has 20 self-check lines, and only one line that will take cash. She said it is called ‘the American tourist line’. They seldom use cards either, everything is Google Pay, or at least touchless. I used a 20 pence pay toilet out in the middle of nowhere – it didn’t accept cash, only Google or Apple Pay.

The US is soooo behind the curve on this”.

Companionship

We don’t know if one Redditor was kidding or not: “What kind of a hooker takes a credit card?”

This article was inspired by this thread on Reddit.

Are We Getting Bullied Into Tipping? When To, How Much And When Not To Tip

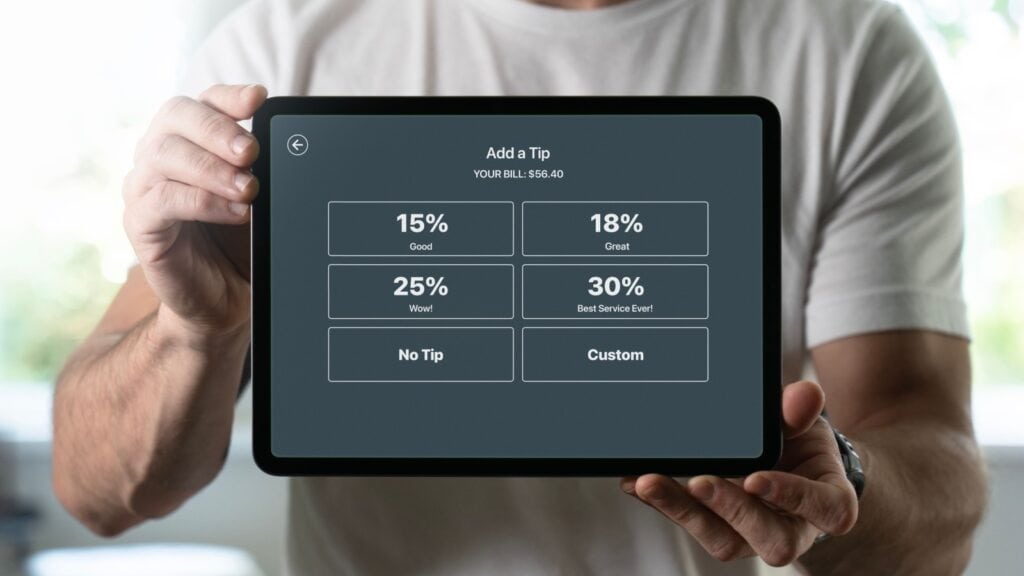

It is happening more and more. You are standing in line at a fast food restaurant or coffee shop, the counter person guides you to the point-of-sale machine and there it is, staring at you. Even at self-checkout machines, a screen comes up suggesting that you tip, complete with an array of amounts, sometimes a dollar amount, other times a percentage.

READ: Are We Getting Bullied Into Tipping? When To, How Much And When Not To Tip

Retire Early, Live Fully: Embracing The FIRE Lifestyle For Financial Independence

The FIRE movement emphasizes the pursuit of early retirement by adhering to a lifestyle characterized by frugality, substantial savings, and strategic investments. Participants aim to accumulate enough financial resources to sustainably cover their living expenses without the need for traditional employment.

READ: Retire Early, Live Fully: Embracing The FIRE Lifestyle For Financial Independence

9 Of The Most Regretted Purchases People Still Regularly Make

Many people regret trying to keep up with the latest trends, whether it’s buying expensive fashion items, fancy gadgets, or luxury cars; the initial excitement often fades quickly, leaving behind feelings of disappointment. It’s essential to focus on what truly brings long-term satisfaction rather than chasing fleeting trends. Let’s take a look at a few trends and costly items that are best avoided. Read: 9 Of The Most Regretted Purchases People Still Regularly Make

Join Us

Join us on this empowering journey as we explore, celebrate, and elevate “her story.” The Queen Zone is not just a platform; it’s a community where women from all walks of life can come together, share their experiences, and inspire one another. Welcome to a space where the female experience takes center stage. Sign up for our newsletter so you don’t miss a thing, Queen!